Daily market commentary

The Launch Pad |

|

|

|

|

|  | |

|

Today

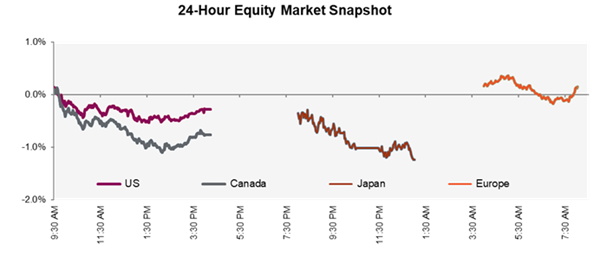

Stock futures are relatively unchanged this morning, following a down day for North American equities with indexes retreating from all-time highs. Despite seeing a small pullback yesterday, equity markets continue to show signs of euphoria, with options data revealing record demand for call options, far outpacing puts for the first time in four years. This rise, driven largely by retail investors and concentrated in AI, semiconductor, and metals stocks, has pushed sentiment indicators like Barclays’ Equity Euphoria Index to levels not seen since the tech bubble. Despite concerns about tariffs, growth, and Fed policy, FOMO is dominating market behaviour. Strategists warn that such exuberance often precedes weaker returns, yet many investors remain reluctant to step back, mindful that betting against a euphoric market can be costly if momentum continues.

Jobs! Canada’s labour market surprised to the upside in September, adding 60,400 jobs, well above expectations, while the unemployment rate held steady at 7.1% as more people entered the workforce. Gains were concentrated in full-time and public-sector roles, with manufacturing alone adding 27,800 positions. The data suggest the job market remains resilient despite U.S. trade tensions and recent economic softness, potentially reinforcing expectations that the Bank of Canada will pause rate cuts at its Oct. 29 meeting. However, total employment remains down over the past quarter, and hours worked fell 0.2%, signaling ongoing slack even amid headline strength.

Japan’s decades-old ruling coalition between the Liberal Democratic Party and Komeito fell apart after talks between LDP leader Sanae Takaichi and Komeito’s Tetsuo Saito broke down over disagreements on regulating political donations, ending a 26-year partnership that had underpinned political stability. The split leaves Takaichi scrambling to form a minority government amid market volatility and a packed diplomatic schedule, including a visit from Donald Trump. The political turmoil jolted currency markets, sending the yen fluctuating around 152 per dollar, and may complicate the Bank of Japan’s rate-hike decisions as inflation pressures persist. Analysts warn the collapse could lead to a fragile government or fresh elections, while Takaichi seeks new alliances with opposition parties to secure parliamentary backing ahead of key international summits.

China has expanded its rare earth export controls ahead of a Trump–Xi summit, adding five new elements, holmium, erbium, thulium, europium, and ytterbium, plus dozens of refining technologies and stricter licensing rules for foreign firms using Chinese materials. The move tightens Beijing’s grip on critical supply chains for semiconductors, defense systems, and EVs, mirroring U.S. export restrictions on advanced chips. New regulations will require foreign companies to obtain Chinese export licenses even if no Chinese entity is directly involved, while defense-related and advanced semiconductor users will face tougher scrutiny. Analysts say the measures strengthen China’s leverage before trade talks and signal a deepening global supply chain split between China and the West. The announcement sent shares of Chinese and U.S. rare earth producers higher, as markets anticipate further disruption and localization in the global rare earths industry.

The U.S. government shutdown continues to drag on with no resolution in sight, disrupting daily life and threatening economic growth as federal services grind to a halt. Air travel delays, shuttered taxpayer assistance, and closed national parks highlight the immediate fallout, while over 250,000 federal workers have already missed paychecks and millions more could soon follow, including U.S. troops if the impasse continues. Economists estimate the shutdown could shave 0.1–0.2% off GDP each week, a hit worsened by the suspension of key government data releases. Critical programs like food assistance and flood insurance face funding shortfalls, and agencies are resorting to ad hoc furloughs to stay within legal limits. Politically, President Trump is leveraging the standoff to pressure Democrats, while the risk of missed military pay and mounting travel chaos could soon force both sides back to the table.

The private credit market is showing signs of strain as investors pull back from business development companies amid falling payouts and weaker sentiment following the Fed’s rate cuts. With most BDC loans tied to floating rates, declining interest income is forcing major funds, including Blackstone’s and Oaktree’s, to trim dividends for the first time, while others are expected to follow as dividend coverage ratios fall. Shares of leading BDCs like Blackstone Secured Lending and Blue Owl Capital have dropped 15–20% this year, reflecting concerns about tighter yields, rising payment-in-kind debt, and potential credit risks, especially in software lending exposed to AI disruption. Although lower rates reduce borrowing costs for lenders, growing competition and investor skepticism suggest the $1.7 trillion private credit market faces mounting pressure as returns compress and defaults loom as a key risk.

Chinese consumer spending during this year’s eight-day Golden Week holiday fell to a three-year low, with average spending per trip down 0.55% to 911 yuan, disappointing hopes that a stock market rally would boost consumption. Despite an increase in total trips and a 15% rise in overall tourism revenue to 809 billion yuan, weak spending highlights ongoing caution amid economic headwinds such as property sector woes, job insecurity, and fierce domestic competition. Analysts said the wealth effect from recent market gains has yet to translate into stronger consumption, while spending patterns showed a preference for short, affordable regional trips and midscale hotels. The box office also suffered, with revenues down nearly one-third from last year due to a lack of blockbuster releases, underscoring muted enthusiasm among consumers.

Not too shabby for a college dropout. Intercontinental Exchange (otherwise known as the other ICE) is investing up to $2 billion in Polymarket at an $8 billion valuation, which makes 27-year-old founder Shayne Coplan the youngest self-made billionaire according to the Bloomberg Billionaires Index. Coplan dropped out of NYU, pivoted from crypto to prediction markets, and launched Polymarket in 2020. It was not an easy road for Coplan that included regulatory trouble, a $1.4 million CFTC settlement in 2022, a post-election FBI raid in 2024, and a U.S. user ban. Regulators dropped their probes in July, and Polymarket bought CFTC-licensed QCEX for $112 million, that allowed it to operate legally in the U.S. ICE’s stake links Polymarket more closely to Washington with investors that include the Founders Fund (Peter Thiel) , Vitalik Buterin (Ethereum founder), investment firms Blockchain Capital, and 1789 Capital, where Donald Trump Jr. is a partner (he is also an advisor and investor in Polymarket).

Diversion: Truly a “wait for it” moment

|

|

|

(% equity weight)

To learn more, please click here.

|

|

|

|  |

|

|

Company news

Qualcomm shares are under pressure after Chinese regulators said it would investigate the American tech giant’s acquisition of chip firm Autotalks, ramping up tensions between the U.S. and China ahead of key meetings between the country’s leaders this month. China’s State Administration of Market Regulation (SAMR) said that Qualcomm is suspected of violating the country’s anti-monopoly law in regards to its acquisition of Israeli firm Autotalks. The acquisition officially closed in June, just over two years after it was first announced. U.S. tech companies have recently been in the crosshairs of Chinese regulators ramping up tensions between Beijing and Washington ahead of key talks. In September, the SAMR alleged that Nvidia had violated the country’s anti-monopoly law in relation to its acquisition of Mellanox and some agreements made during the acquisition. Meanwhile, Beijing has reportedly been discouraging local firms from buying Nvidia chips.

Headlines are surfacing that Baytex Energy is weighing an exit of its operations in the Eagle Ford shale of south Texas to refocus on its domestic assets. Baytex, which significantly extended its reach into the basin just two years ago via a takeover of Ranger Oil, is working with advisers to solicit interest in the operations, which could they could sell for as much as $3 billion. The potential sale would be a significant turnabout for Baytex, which touted the Ranger deal at the time as an opportunity to double free cash flow and deliver at least a dozen years of oil-weighted drilling opportunities.

|

|

|

|

Commodities

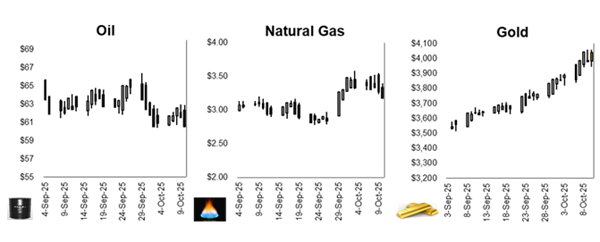

Oil prices extended the biggest decline in a week on cautious optimism about easing tensions in the Middle East and the outlook for supply. Traders were also on alert after the U.S. sanctioned more than 50 individuals, firms and vessels involved in the Iranian energy trade, including a key crude-import terminal and a privately-owned Chinese refinery. It’s the latest in a series of sanctions this year that have targeted companies in the Asian nation. In response, China also slapped port fees on American ships in retaliation for similar U.S. measures. Hanging over the energy market has been the growing surplus fueled by rising output from both outside and within the OPEC+ alliance, which agreed to raise production quotas to reclaim market share over the weekend.

Silver is higher for a second day and now nearing a record high as a historic tightening of the London spot market added steam to a rally driven by demand for safe haven assets. Spot prices rose as much as 3.7% above $51 an ounce, while the cost of borrowing the precious metal for one month in London soared to an annualized record of 35%. Earlier this year, fears that the U.S. could put tariffs on silver spurred a surge of metal to New York (similar to copper), drawing down inventories in London and reducing the amount of metal available to borrow. However, much of the silver in London is held in vaults backing ETFs, and not available to buy or borrow on the market. The tightness in London has led a typical premium of a few cents for futures in New York to collapse into a discount of more than $2.50 an ounce below spot prices. The scale of that dislocation may end up easing market tightness in London, as traders buy cheaper metal in the US and ship it to the UK to capture higher prices. But for now, the squeeze is driving prices closer to a $52.50-an-ounce record from 1980, set on a now-defunct contract on the Chicago Board of Trade. Silver is up more than 75% this year, by far outpacing gold’s advance.

|

|

|

|

|

Fixed income and economics

In Japan, a five-year government bond auction yesterday met solid demand, helping ease investor concerns over supply issues fueled by expectations of expansionary fiscal policies from Japan’s likely next leader. The bid-to-cover ratio, a gauge of buyer demand, was 3.69, almost the same as the previous sale in September and matching the 12-month average. Markets were on edge ahead of the auction on prospects of more government spending after Sanae Takaichi’s election as the new Liberal Democratic Party leader triggered a selloff in longer-term government bonds. Takaichi is expected to be chosen as Japan’s next prime minister in a meeting of the parliament later this month. Speculation has the Takaichi victory may delay the continued normalization of the BOJ’s policy, leading swap markets to slash the odds of a rate hike this month to 25% from over 50% before the LDP leadership vote. While fading rate hike expectations should lend support to shorter-end bonds, the yen’s continued weakness, with the currency sliding to an eight-month low against the dollar this week, has increased concerns over inflation. That may in turn pressure the central bank to take action. Market attention has now shifted to Takaichi’s cabinet nominations. She has yet to reach an agreement with the party’s long-time coalition partner Komeito about continuing their alliance.

|

|

|

|

Quote of the day

|

Be thankful for what you have; you'll end up having more. If you concentrate on what you don't have, you will never, ever have enough.

Oprah

|  |

|

|

Contributors: A. Innis, A. Nguyen, P. Kwon

|

|

|

Charts are sourced to Bloomberg unless otherwise noted.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

|

|

| Address: 100 Queens Quay East, Suite 2500 Toronto ON M5E 1Y3 Canada

|

|

|

|

|