Thursday, April 12th, 2018

Contributors: J.Price, C.Basinger, D.Benedet, C.Kerlow, D.Mak, S. Obata

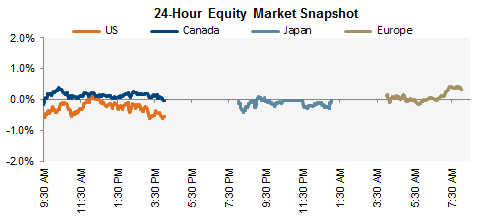

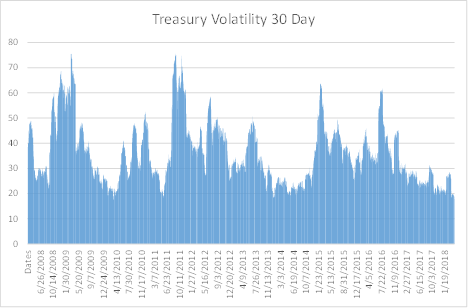

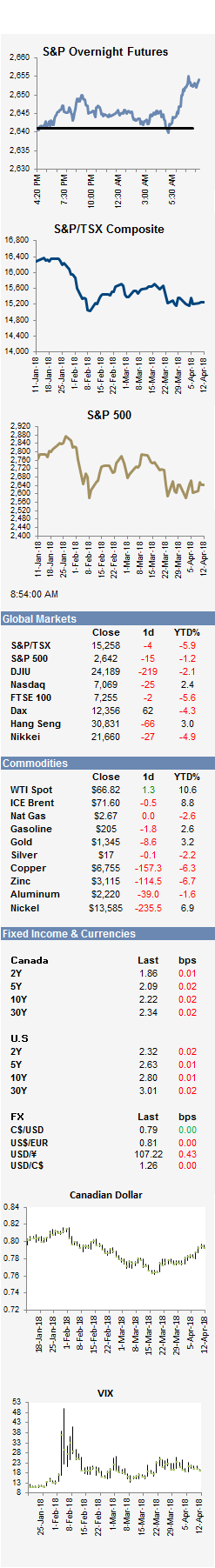

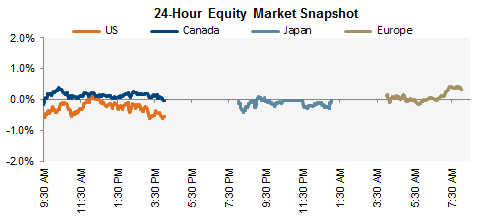

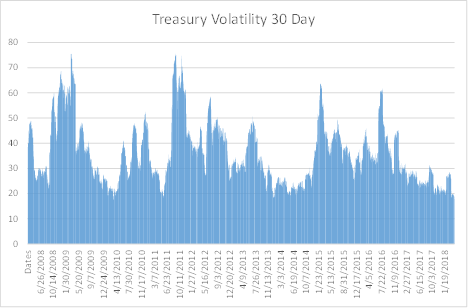

TODAY The see-saw continues this morning as European stocks are turning a corner and pushing higher into the morning after starting in the red. Local futures are pointing to gains on the open, while treasury bonds do little. Interesting that the volatility of 10 year treasury yields is actually hitting lows here, despite the renewed life of Vol in the equity markets.

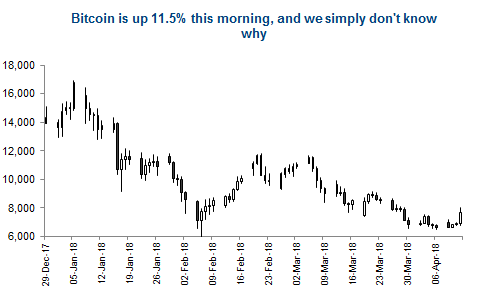

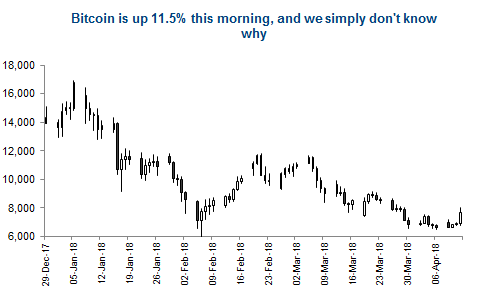

Meanwhile in “currencies” bitcoins are surging for no apparent reason while the rest of the currency complex shows little changed on the day. We will point to the loonie, which has quietly gained U$0.02 in the month of April so far, despite little improvement in the 2 year bond yield differential. One needs to look no further than the price of Western Select Canadian crude which is quickly narrowing the gap to WTI oil.

Based on the latest quarterly data from Blackrock, the world’s largest asset manager the flow into ETFs has slowed as ETF flows slowed by 46% last quarter. Whether it’s the increase in volatility that slowed or perhaps a natural reduction in pace considering they now manage $6.3 trillion. Regardless of pace, the flow was still positive and shows that ETFs continue to capture a large chunk of money in motion. The slowdown in flow is also a testament to how the average person is either hesitant to invest, or quick to sell when the market is down – opposite to the traditional buy low sell high mentality.

The IRS now wants its cut from star hedge fund manager John Paulson, to the tune of $1 billion. It’d be the largest individual tax bill owing ever. To put it into perspective, it’s about the same as the bottom 50% of US taxpayers pay collectively. This is certainly one of those first class headaches, as he made about $4 billion in his one in a lifetime bet before the financial crisis. (WSJ)

From the Fed minutes yesterday it looks like all members see higher GDP and inflation on the way. Some noted the pace of steepening may increase but for now the market seems to be maintaining the status quo in terms of yields.

An aside: Clicking around my Bloomberg terminal while periodically checking my iPhone, I can easily forget the profound impact innovations from Apple have on my life (the mouse / iPhone). However, their latest product the HomePod does not seem to be as well received. The smart speaker that was created to rival Amazon’s Echo, has disappointed and Apple has lowered forecasts and reduced orders from Inventec, one of their largest suppliers of the device.

Diversion: Pretty sure the quality of this photo-shoot far outstrips the quality of the car it is trying to sell.

“We either do nothing or we overreact” - House Republican Billy Long on Congress yesterday at the Zuckerberg hearings.

So it’s true, millennials are living with their parents.

COMPANY NEWS Disney is being forced to make a takeover bid for Sky Plc by the U.K regulators if they want to complete their purchase of 21st Century Fox. They would have to bid 10.75 pounds, matching the bid by Fox for Sky back in 2016. It is being rumored that General Electric is looking to spinoff their locomotives unit. This is part of a larger plan to divest at least $20bb in an effort to transform the business. The Canadian government is not ruling out taking a stake in the Trans Mountain pipeline, which is being built by Kinder Morgan to help make sure the project moves ahead. This comes after the pipeline company announced earlier this week that they would shut down construction if opposition continues.

JPMorgan has been accused of charging surprise fees for crypto purchases and high interest rates on the cash advances than the credit cards. Barclays’ former head of information security was asked to leave after being found to have billed personal expenses to the company.

Diminishing advertising sales sank Postmedia’s Q2 revenue nearly 11% after Ontario government helped trim with a $17mm tax credit regardless. The Big Five, together with National Bank are poised to pursue acquisitions and share buybacks when stepping into their strongest capital position year since 2013. Maple Leaf Foods is investing in Entomo Farms’ crickets and whole-roasted insects as an alternative form of protein, filming a new episode of Man vs. Wild 2.0.

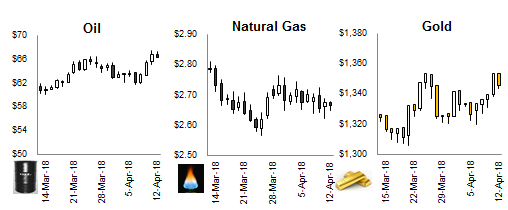

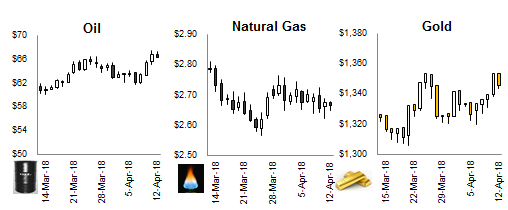

COMMODITIES Oil remains in the mid $60s, thanks mainly to rising tensions in Syria. This ahead of OPECs monthly report today but given past months, expect to see continued restraint on production. Aluminum prices, which have jumped 10% in the past few days, is cooling. There is a bit of a supply squeeze going on, plus further complications due to new tariffs.

IEA comments are indicating the market will remain well supplied with oil for years to come.

Discounting supply risk due to rising tensions, they also highlighted the 2nd wave of production from shale. The U.S., which is still a net importer, is exporting 1.6 million barrels a day. This used to be largely banned but restrictions were lifted about a year ago. In fact they have recently upgraded some loading platforms to have oil flowing out as well as into the U.S. These platforms are the ones used by VLCC and ULCC ships. VLCC = Very Large Crude Carrier and ULCC = Ultra Large Crude Carrier. Great acronyms.

“Oil price spikes after Houthi missiles target Saudi Arabia” – $FT

“OPEC sees higher 2018 oil supply from rivals, stronger oil demand” – RTS

“Fresh from bankruptcy, driller Fieldwood hungry for U.S. offshore output” – RTS

“OPEC's Barkindo sees oil market rebalancing in Q2-Q3” – RTS

“Deripaska’s Two-Decade Wooing of U.S. Ends in Financial Meltdown” – BBG

FIXED INCOME AND ECONOMICS Bond markets continue to be roiled by the ongoing tweets and comments from US President Trump, with the conflict in Syria the latest point of contention. After sparking flight to quality flows yesterday when the President suggested missile strikes could be imminent, last night Trump stated an attack on Syria “could be very soon, or not soon at all”. This has bond yields opening higher to start the day, notably with the 30-year Treasury rising back above the 3.00% level.

The longer term trend in bond markets however continues to be a flattening yield curve. A year ago, the US 10-year Treasury yielded 1.07% more than the 2-year note; today, that spread stands at just 0.47%. Solid economic data has markets expecting the Federal Reserve to hike rates again in June by 0.25% to be followed by another quarter point hike towards the end of the year, but with inflation still contained, we may not see much of a rise in longer term yields. That suggest we could have a flat or even inverted yield curve in the coming months, a situation that usually precedes a recession. We are not there yet, but the curve bears watching.

CHART OF THE DAY

QUOTE OF THE DAY

|

Another flaw in human character is that everybody wants to build and nobody wants to do maintenance.

— Kurt Vonnegut

|

|

|