Wednesday, April 4th, 2018

Contributors: J.Price, C.Basinger, D.Benedet, C.Kerlow, D.Mak, S. Obata

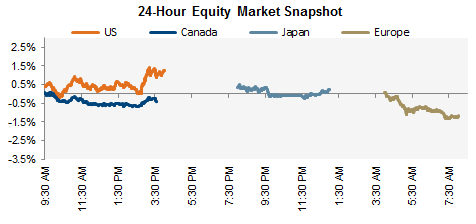

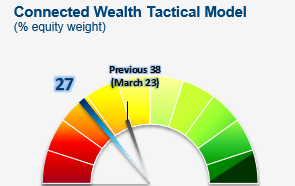

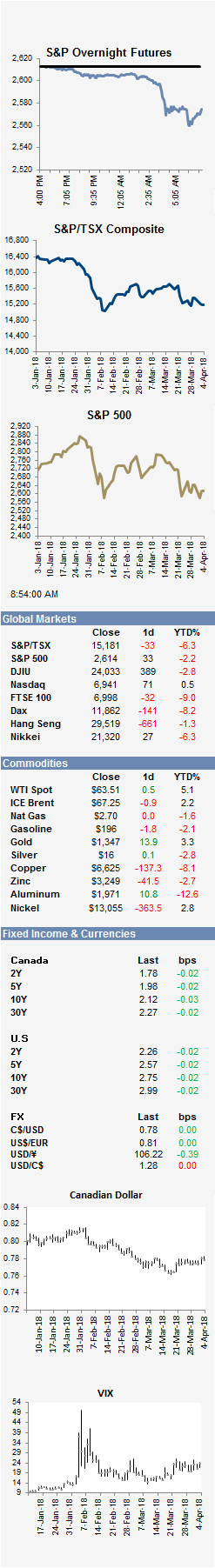

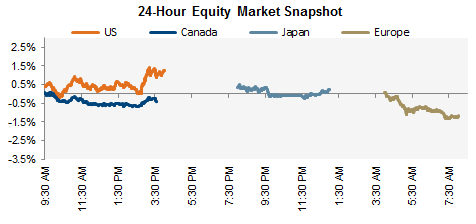

TODAY The story overnight is geopolitics as China hits back in the trade war that was recently set into motion. Equities overseas are in sell mode and early futures are way down. China said it will impose a 25 percent tariff on imports of 106 American products including soybeans, autos, chemicals and aircraft, after the proposed U.S. duties on its high-tech goods. Bloomberg reports more here. The 25% levy targets U.S. imports such as soybeans, cars, whiskey. The full list can be found here.

Trump however is adamant on Twitter that the U.S. is not in a trade war with China as they lost that war many years ago.

Bond markets are reacting by pushing yields a little lower, but seem a bit confused. In the short term, consumer prices will be going up if this trade war heats up, but long term we all know that taxation is deflationary. Surprisingly, currency markets are relatively tame this morning. US and Cdn dollars are unchanged, while Yen is showing a little strength.

The fear gauge is also tilting higher, as the CBOE Market Volatility Index (VIX) inches back up towards 25. It has been rather curious that despite the retest of the lows from February (those will be taken out today) the market was doing so in a more subdued fashion.

The reports are out on Toronto’s housing market showing some massive click-bait headlines like this one: Toronto home sales fall 39.5% year-over-year in March. At least this one says year-over-year. Don’t forget the frenzy a year ago, and most of the decline in activity happened immediately after that. More recently the market has been mostly flat. David Rosenberg had some comments at the end of his “Adventures in Finance” podcast (which you should listen to), where he points out that the Vancouver and Toronto markets are far from representing Canada as a whole. Vancouver is a distant 3rd in terms of population size, and 5 of the other top ten areas are far from a bubble.

It is notable that the GDP number reported on Friday showed a big -0.5% drop on the month for the Real Estate contribution to overall GDP. Year-over-Year, it still shows a healthy 2.3%, but we know where this lagging number is heading as we report Q1 GDP at the end of May.

Business Insider shares J.P. Morgan’s ultimate guide to the markets and the economy. The quarterly publication is a wealth of information.

Diversion: Copenhagen is starting to building floating parks? Could this be next for False Creek or Toronto Harbour?

COMPANY NEWS The headwinds for Boeing just became firmer with new tariffs from China slapping a 25% tariff on U.S. Aircrafts. This gives a leg up to their largest competitor Airbus, which is already taking a shot at the top spot in the industry. China is expected to add 921 million passenger planes by 2036 according to the International Air Transport Association. It is believed that Apple is working on new touchless gesture technology as well as curved screens for future iPhones. The new iPhone X’s OLED screen actually curves slightly at the bottom, but the convexity is basically invisible to the human eye. New information has arose as the Department of Justice reviews AT&T’s proposed takeover of Time Warner Cable. It appears like an independent prediction by the University of California may have been tweaked in regards to the total costs to Charter Communications and its subscribers. Spotify (SPOT) traded for the first time yesterday. While not technically an IPO as the direct listing did not raise any capital the shares had a volatile day as the market decided on a price. It initially at $165.90 only to close the day below $150.

Hershey pins high hope on a renovation of Kisses, its iconic chocolate to produce from sustainable cocoa with a $500mm investment plan amid tightening global cocoa supplies. Canadian dairy shop Saputo won approval from regulators for the proposed $1bb acquisition of Murray Goulburn after agreeing to sell a milk production plant in Australia.

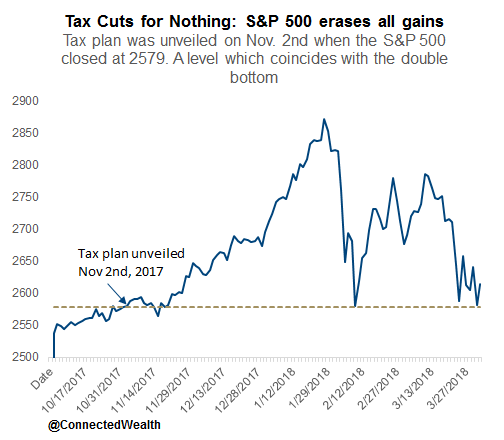

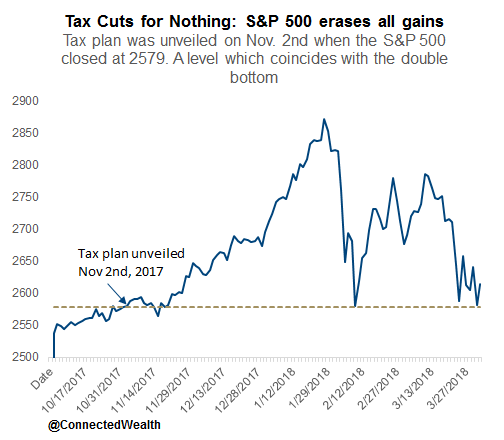

FIXED INCOME AND ECONOMICS “We are not in a trade war with China”. That’s the opening salvo from President Trump’s official Twitter account this morning in response to the Asian superpower announcing a ten-fold increase overnight to a tariff package with the United States. Equity futures are down sharply, the U.S. 10 year is erasing all losses yesterday to trade a quarter point higher, while the long end drifts back below the 3% yield level. Should markets really be reacting so violently at China’s announcement? Commerce Secretary Wilbur Ross doesn’t think so as he told CNBC earlier that "I'm frankly a little surprised that Wall Street was so surprised by it. This has been telegraphed for days and weeks" and that the China's tariffs "amount to about three-tenths of a percent of our GDP. So, it's hardly a life-threatening activity.” Tweets and media interviews aside, for those who can remember, President Bush enacted an 8%-30% foreign steel tariff on March 6, 2002. That set off a chain reaction beginning with the European Union responding with tariffs of their own and a number of countries disputing the levies at the World Trade Organization. Less than a year after the announced measures, the WTO ultimately ruled that the U.S. had violated international trade agreements by imposing the tariffs, opening the door for sanctions and retaliation. Bush ended up reversing the policy in late 2003 but not before volatility engulfed markets (within six months the S&P 500 fell -33%, the 10 year Treasury yield slipped from 5% to 3.63%, and the DXY lost -10%).

Amidst the trade talk we do have some fundamental economic data to digest today starting with the ADP Employment Survey indicating that +241K jobs were created in the U.S. private sector last month. That bested the +210K expectation and brings the Q1 average to +243.57K new workers added to the labor force --- the highest quarterly mean since Q2 2014. More than half of the hires came from medium (between 50 and 500 employees) sized businesses while 73% of the additions were to the service sector. It’s a good print overall and bodes well for an upside beat in Friday’s nonfarm payroll expectation. At the moment, pundits have really lowered the bar for job gains in March with just +185K expected compared to the +313K printed in February, so the hurdle here isn’t too hard to leap over. But it’s worth reminding readers though that yes, while it’s always nice to see a beat in all economic releases, we must always use context when validating the expectation --- ranges for Friday’s number are far-flung from as low as +90K to as high as +255K. March PMI numbers are out after the open (bullish print expected) while February factory orders and durables numbers follow shortly after. The results would normally matter but are likely to be a footnote in today’s session dominated by the new trade measures.

CHART OF THE DAY

QUOTE OF THE DAY

| The Edge... there is no honest way to explain it because the only people who really know where it is are the ones who have gone over.

- Hunter S. Thompson

|  |

|