Daily market commentary

The Launch Pad |

|

|

|

|

|  | |

|

Today

Equities are extending their climb this morning, building on gains made yesterday in U.S. markets after Fed Chair Jerome Powell said policy makers have made progress in the battle against inflation. The comments raised hopes the central bank may be nearing the end of its rate-hike cycle, despite Powell being quick to note that further hikes may be in store. Stocks in Europe are also extending gains this morning after the ECB and BOE joined the tightening party, lifting their benchmark rates by 50 bps (as expected) and saying they will review their path for their next meeting.

As expected, the Fed lifted its target for its benchmark rate by 25 bps to a range of 4.5% to 4.75% yesterday. The move follows a half-point increase in December and four jumbo-sized 75 bp hikes prior to that, which amounted to their most aggressive tightening campaign in four decades. The central bank also said that ongoing increases in the target range will be appropriate in order to return inflation to its target of 2%. The positive out of yesterday’s hike came after FOMC members said that the extent of future increases will depend on a number of factors and noted that inflation has eased in recent months. Across the pond, the Bank of England just announced its own rate hike of 50 bps to its key interest rate, but also signaled it may soon pause as inflation eases and the economy slows.

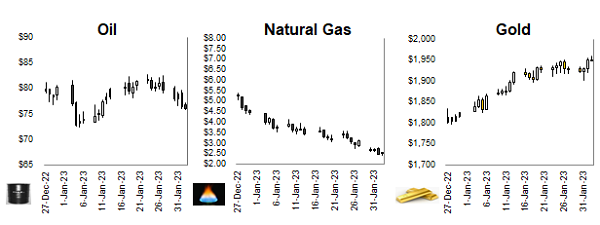

Inflation in Europe slowed more than expected in January, reigniting the argument over how much further the ECB should increase interest rates. Last month’s inflation reading came in at 8.5%, less than the 8.9% estimates, thanks in part to lower energy prices. Still, core measures of underlying inflation which exclude volatile items like energy remain at an all-time high of 5.2%. More dovish ECB officials will certainly use these numbers to push for an easing in the pace of rate hikes following today’s anticipated half-point move. Bolstering dovish ECB officials’ arguments include falling natural gas prices amid a mild winter and expectations of a similar downshift by the Fed and a pause in the BoC’s monetary-tightening cycle.

Vacancies at U.S. employers rose at the end of last year, with the number of available positions rising to a five-month high of just over 11 million in December from 10.4 million in November. This highlights the solid appetite for labour and subsequent wage pressures, one of the last hurdles to ease inflation. Data also shows that job openings also increased in retail trade and construction while vacancies decreased in the information sector. Overall, the ratio of openings to unemployed people rose to a near record-high 1.9 in December from 1.7 a month earlier and much higher than the pre-pandemic number of around 1.2. And if that wasn’t enough to worry the Fed, applications for unemployment benefits in the U.S. also fell for the fourth time in five weeks, underscoring the broad resilience of the job market. Initial unemployment claims ticked down by 3,000 to 183,000 in the week ended Jan. 28, while continuing claims, which include people who have already received unemployment benefits for a week or more, fell to 1.66 million in the week ended Jan. 21.

HIIT or sculpt? If you answered neither, you can move onto the diversion now. If you answered the latter, you are part of a trend that is choosing more moderate exercises that focus on strength training and mobility (must keep those wobbly knees and hips strong). According to the WSJ, fewer people are choosing high calorie burning HIIT (high-intensity interval training) workouts and instead opting for sculpting classes such as pilates, yoga, and strength training. Based on the subscription-based fitness platform ClassPass, bookings in the “sculpting” category grew 280%, vs. HIIT growing 59%. Either way, more people have returned to gym, which is a win-win for gyms our health. Happy sculpting.

Diversion: Fun starts now...not.

|

|

|

(% equity weight)

Our tactical fund is designed to complement your existing holdings to minimize portfolio volatility. To learn more, please click here.

|

|

|

|  |

|

|

Company news

Rogers Communications Inc. reported fourth-quarter profit that topped analysts’ estimates as an increase in subscribers boosted revenue in its largest unit. The company’s wireless unit, its most important business, added a net of 193,000 postpaid subscribers. The cable unit continued to remain stagnant and show slowing growth, with its total customer relationships increasing 0.3% from a year earlier. Rogers is in the final stages of trying to finish its C$20 billion takeover of Shaw Communications Inc. The companies pushed the deadline to close to Feb. 17 while they await a final ruling from Industry Minister Francois-Philippe Champagne.

BCE Inc. missed on earnings and reported a fall in fourth-quarter profit, slightly more than expected, as impairments and higher costs ate into profit, while strong segment performance helped drive revenue above forecasts. The decline was largely due to higher asset-impairment charges mainly related to Bell Media's French-language TV properties, higher interest expenses as well as lower advertisement revenue. BCE also announced a dividend raise of 5.2%.

Meta reported better-than-expected advertising sales during the holiday quarter and more users for its Facebook social network. Revenue for the fourth quarter was $32.2 billion, beating analyst estimates of $31.6 billion. Shares surged after the earnings release and $40 billion buyback boost, helping the stock to open close to 20% higher this morning.

More tech giants report earnings after markets close today, including Apple, Amazon, and Alphabet. Analysts are expecting Apple to announce its first revenue decline since 2019 with iPhone 14 sales in focus while Amazon may reveal its slowest sales growth in more than two decades. Alphabet's ad pricing is expected to have held up but operating profit remains under pressure.

Adani Enterprises Ltd. called off its $2.5 billion share sale yesterday, following a tumultuous week which saw the conglomerate shed tens of billions of dollars in market value after claims of fraud. Citing a volatile market and an unprecedented situation, the Adani Group said it decided not to go ahead with its share sale, which was preliminarily sold out as of Tuesday, and will return the proceeds from the offering.

|

|

|

|

Commodities

Gold is shining again and rose to a nine-month high after the Federal Reserve signaled its aggressive cycle of rate hikes may be coming to an end, stating that policy makers expect to deliver a “couple” more interest-rate increases before putting their tightening campaign on hold. The U.S. dollar and Treasury yields extended declines on Thursday, pushing gold higher. The yellow metal has rallied for three straight months through January, the longest such sequence since the middle of 2020, largely due to signs the Fed was getting less hawkish.

Global sugar prices have been on a tear, soaring this week to the highest since late 2016, as prospects for weaker India exports, plus higher gasoline prices in Brazil (which may prompt sugar mills to boost ethanol production at the expense of sugar) sparked concerns about a near-term global shortage. However, the price surge may be tested as Thailand, the world’s second-largest sugar exporter, will ramp up production and shipments, and will produce 11.55 million tons of sugar this season, up 14% from the previous year. This will lead to greater exports, with the domestic market typically consuming about 2.5 million tons and selling the rest overseas.

|

|

|

|

Fixed income and economics

One more jumbo for the road, well maybe not for the ECB. The European Central Bank lifted interest rates by a half-point raising the deposit rate to 2.5%, the highest since 2008. More importantly the ECB pledged that borrowing costs will hike by that amount again next month to ensure retreating inflation arrives back at target. They warned that the most aggressive bout of monetary tightening in ECB history isn’t done, even as energy prices plunge, and the Federal Reserve moderates the pace of its own hikes.

The Bank of England raised its key interest rate this morning for a 10th straight policy meeting but signaled it may soon pause that series as the annual rate of inflation falls and the economy falters. Unlike the Fed and the BoC, who raised by 0.25%, the BOE hiked 0.50% bringing its bank rate to 4% from 3.5%. The BOE said further rate rises are possible, but only if inflation threatens to be high for longer than it currently expects it to be. The central bank had previously set a lower bar for further rate rises, but also warned of the risk that a tight jobs market and big pay rises would keep inflation higher for longer than it anticipates. The decision came with a bleak outlook, with the central bank forecasting a recession in 2025 and supply potential in the economy a little more than half of its previous estimate.

|

|

|

|

Quote of the day

|

He who does not know how to look back at where he came from will never get to his destination.

Jose Rizal

|  |

|

|

Contributors: A. Innis, A. Nguyen, P. Kwon, M. Letchumanan

|

|

|

Charts are sourced to Bloomberg unless otherwise noted.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

|

|

| Address: 100 Queens Quay East, Suite 2500 Toronto ON M5E 1Y3 Canada

|

|

|

|

|