Daily market commentary

The Launch Pad |

|

|

|

|

|  | |

|

Today

All eyes are on the Fed today as they announce their rate decision. Expectations are for a 25-bps rise, marking the second consecutive meeting the central bank has slowed the pace of its rate hikes. While the market has priced in another 25-bps increase at the next meeting in March, cooler pay gains have left investors wondering about the possibility of a Fed pause as early as Spring. Equities finished the month strong, as investors were buoyed by signs of easing labour costs in the U.S. and cooling inflation. Gains in equities yesterday added to January’s rally, with the S&P 500 having its best month since October and the TSX having its best month since November 2020. Those gains were not able to extend into February though, with futures struggling for direction as investors brace for today’s Fed meeting.

The IMF raised its global economic growth outlook for the first time in a year, forecasting GDP to expand 2.9% in 2023, 0.2% more than forecast last October. The updated figures would still signify a slowdown from a 3.4% expansion in 2022, however, the IMF said it expects growth will bottom out this year and accelerate to 3.1% in 2024. Risks to global growth include China’s recovery potentially stalling, the war in Ukraine escalating, more emerging and developing economies entering debt distress, and of course central banks’ interest-rate hikes. Even with these potential headwinds, the IMF sees world consumer-price increases slowing to 6.6% this year and inflation rates to be lower in about 84% of countries in 2023.

Despite Vancouver and Toronto having the highest home prices, the loan-to-value ratios in those cities are the lowest in the country according to a Re/Max report. Loan-to-value ratios averaged 50% in Vancouver and 53% in Toronto as of Q3 2022, lower than the national average of 57%. The report also found that Regina and Edmonton had the highest loan-to-value ratios at 88% and 83%, respectively. Home prices have surged (until recently) in some of the biggest markets around the country, lowering loan-to-value ratios for homeowners' who owned before prices began to skyrocket (cold comfort for those who are looking to become homeowners now). Experts are warning that the ratios could drastically shift as well as borrowing costs rise, especially for those who opted for a variable mortgage when rates were ultra-low.

High yield borrowers are busy refinancing debt after the biggest January rally in years. Companies are taking advantage of investor demand, as signs emerge that inflation is softening. Investors are also hoping that at the conclusion of the Fed’s meeting today, the central bank will slow the pace of its rate hikes, which would help push bond yields lower. Corporations have a lot of refinancing to do with high-yield issuers holding over $100 billion in bonds and about $330 billion in loans due through 2024. Some estimates are also showing that high yield bond sales to refinance debt, including floating-rate loans, could reach $135 billion in the U.S. this year, up from about $50 billion in 2022. Despite having to pay more interest on new debt, companies are seizing their opportunity now as volatility may creep up in the coming months.

Employment costs in the U.S. rose at a slower-than-expected pace in the final months of 2022, reinforcing the case for a smaller interest-rate increase by the Fed today. The employment cost index increased 1% in Q4, less than the 1.1% economists estimated. Still, labour costs have risen at least 1% for six straight quarters, extending what was already a record streak going back to 1996. The data is consistent with other measures that show wage growth is slowing, though it still may not be enough for the Fed to feel confident that inflationary pressures have been stomped out for good.

Hot off the press – Tom Brady is retiring, again. The GOAT (debate all you like) just announced his retirement via a twitter post, saying simply this time his retirement is “for good”. Brady spent 23 in the NFL with the Buccaneers and New England Patriots. The five-time Super Bowl MVP has piled up career records such as most touchdown passes (649) and most passing yards (89,214). He was also the most hated man by every fan of other AFC East teams between 2003 and 2019.

Diversion: Really, first time on live TV? You’re a natural.

|

|

|

(% equity weight)

Our tactical fund is designed to complement your existing holdings to minimize portfolio volatility. To learn more, please click here.

|

|

|

|  |

|

|

Company news

Attention all shoppers! Loblaw is ending its price freeze on more than 1,500 No Name products, even as Canadians continue to face rising prices at grocery stores. The price freeze that was first implemented on all private label No Name items in October came to an end yesterday. Since the price freeze began, food prices have remained stubbornly high with grocery prices growing 11% in December and 11.4% in November.

Surging oil prices helped propel Exxon Mobil to its highest annual profit – ever. The largest U.S. oil company reported annual earnings of $55.7 billion in 2022. This marks a stark turnaround from 2020 when the company reported its first annual loss of $22 billion in four decades after the oil market collapsed and its shares declined over – 40% that year. Exxon shares finished the day +2% after it reported its earnings, adding to its +80% gains in 2022.

McDonald shares declined after the company reported weaker than expected operating margins. Higher costs for ingredients, fuel, and labour cut into the company’s top-line results, which grew 12.6% from a year earlier. Chief executive Chris Kempczinski said he expects a mild to moderate recession in the U.S., and a deeper one in Europe, but noted the consumer is holding up better than expected. The company will focus on new restaurant openings to help drive growth, with 1500 net new restaurants expected in 2023.

Well that’s a different strategy. Intel Corp., struggling with a rapid drop in revenue and earnings, is cutting management pay across the company to cope with a shaky economy and preserve cash for an ambitious turnaround plan. CEO, Pat Gelsinger, will be taking a 25% cut to his base salary and his executive leadership team will see their pay packets decreased by 15%. Senior managers will take a 10% reduction, and the compensation for mid-level managers will be cut by 5%. The move follows a gloomy outlook from Intel last week, when the company predicted one of the worst quarters in its more than 50-year history.

|

|

|

|

Commodities

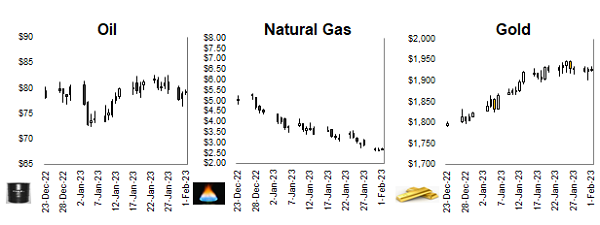

It’s always interesting to watch gold on FOMC rate announcement days. Gold is little changed today and have been somewhat rangebound in the last week as gold bugs await the outcome of the Federal Reserve’s policy meeting for guidance on its rate path. Bullion slipped close to $1,900 an ounce in the previous session before rebounding as data showed US employment costs rising at a slower-than-expected pace. Gold has rallied over 15% since November on bets the central bank would ease the pace of its monetary tightening but has stalled in recent weeks as the outlook remains unclear.

India will spend less on a food subsidy program that feeds 800 million people after the government stopped providing some grain for free. According to Finance Minister Nirmala Sitharaman’s budget presentation, spending will be cut to 1.97 trillion rupees ($24 billion) in the new fiscal year starting April 1 from an estimated 2.87 trillion rupees this year. However, that’s still double the pre-pandemic level of about 1 trillion rupees. The reduction in food-subsidy spending comes as the government wants to shrink its overall budget deficit — seen as key to winning a higher credit score from ratings companies and preserving investor faith in the economy.  |

|

|

|

Fixed income and economics

It’s Fed Day, language will be critical and jumbo hikes may be a thing of the past. The Federal Reserve is expected to raise rates by a quarter point, its smallest increase since it began hiking rates last March. Despite the small raise, most believe that Fed Chair Jerome Powell will be hawkish and his commentary will lean toward tighter policy and keeping interest rates high. While the meeting is expected to be relatively uneventful, strategists say it could be a challenge for the Fed chief to subdue the reaction in financial markets. The markets have been optimistic as investors are now starting to believe that the central bank might succeed in a soft landing for the economy while also snuffing out inflation sufficiently to move back to easing policy.

Europe’s primary bond market has just finished its busiest month ever, with more than €292 billion ($318 billion) in sales. The surge in bond sales, which has not just been in Europe, has been driven by the growing appetite for risk of investors nearly a year after Russia’s invasion of Ukraine last February which effectively froze credit markets, especially for junk-rated companies. January has kicked off the year with optimism that inflation may have peaked, and also a milder European winter has curbed fears over a doomsday scenario of blackouts across the continent and deep economic recession. Remember how concerning natural gases shortages were a couple months ago. According to data compiled by Bloomberg, Sovereigns, supranationals and agencies (or broadly the public sector), accounted for around 44% of Europe’s issuance in January, followed by financial institution groups at 41%. The sales total beat the previous monthly record, from January 2020, by a whopping €54 billion.

|

|

|

|

Quote of the day

|

Expect problems and eat them for breakfast.

Alfred A. Montapert

|  |

|

|

Contributors: A. Innis, A. Nguyen, P. Kwon, M. Letchumanan

|

|

|

Charts are sourced to Bloomberg unless otherwise noted.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

|

|

| Address: 100 Queens Quay East, Suite 2500 Toronto ON M5E 1Y3 Canada

|

|

|

|

|