To hear an audio spoken word version of this post, click here.

What does it mean when markets go long periods of time without a meaningful pullback?

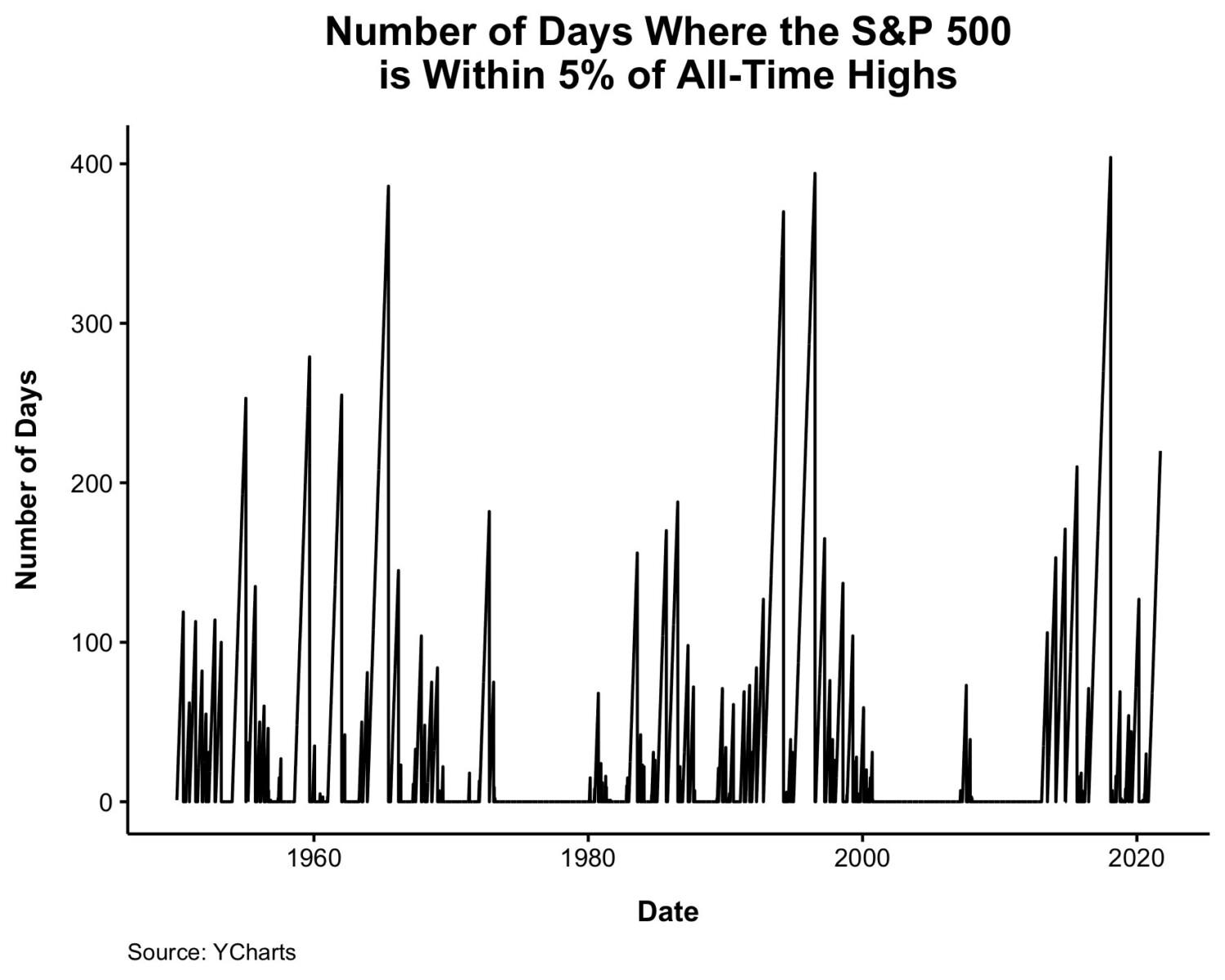

As Batnick shows, there have been several periods in the 1960s, 1990s, 2020s where the market went ~400 trading days without a meaningful 5% pullback. That makes this either a once in a 30-year phenomenon or (more likely) just a random coincidence.

As Batnick shows, there have been several periods in the 1960s, 1990s, 2020s where the market went ~400 trading days without a meaningful 5% pullback. That makes this either a once in a 30-year phenomenon or (more likely) just a random coincidence.

As you can deduce in the chart at right, markets continued to trend after those long streaks ended. In terms of capital flows, market structure, internals, technicals, etc. I am not sure the long streaks without significant drawdowns are especially meaningful.

But where I fear the streak has an ominous meaning is NOT in what the markets might do, but rather what the response of a substantial number of investors might be in the latter stages of these streaks.

Simply stated, easy gains combined with an extended lack of pullbacks leads people to engage in poor decision-making.

Here are a few examples:

• Brains or Bull?: The march upwards from the pandemic lows has led many traders to believe they are investing geniuses. After all, every buy the dip purchase is a winner (if you ignore the math behind it), every stock selection shows your investing savvy, each trade more proof of your acumen. Humphrey Neill, regarded as the father of contrarian analysis, set those folks straight decades ago: “Don’t Confuse Brains With a Bull Market.”

• Risk: A one-sided market leads people to engage in increasingly risky behavior (rather than throttling back). This is what I call the earthquake insurance problem: After a big temblor, earthquake insurance sales spike — just as the odds of another quake go down precipitiously.1 In markets, we become more risk-averse following weak market periods, and become increasingly risk-embracing as stocks go higher. This is the problem with most risk tolerance questionnaires — they mostly inform you about what the market has done for the past 60 days, not of that individual’s actual risk tolerances.

• Luck versus Skill: The role of randomness in the investing process is a fascinating issue to untangle. Cognitive bias leads investors to find it difficult to accept evidence of a lack of skill on their own part; it’s always the other guy that got lucky but your own success is clearly driven by your superior skills. It’s not just day-traders who are challenged in discerning what is mere good fortune and what is actual skill; it is an issue in Business and Sports as well. Michael Mauboussin addresses this in “The Success Equation.”

• Relax, it’s easy! “How do we make money day trading from, home? We only buy stocks that are going up; if they don’t go up, we won’t buy them!” The Dunning Kruger effect makes it oh-so-easy to confuse luck and skill. Consider this couple’s trading advice on TikTok:

A sneak peek of one of our top secret trading strategies. h/t @ryanfeller_ pic.twitter.com/V2PFee7vu4

— TikTok Investors 🎲 (@TikTokInvestors) January 17, 2021

• Volatility: The return of volatility is always revealing. To come full circle, when vol rises, we can begin to distinguish what was truly skill and what was mostly luck. Or as Warren Buffett more colorfully described it, “Only when the tide goes out do you discover who’s been swimming naked.”

The bottom line is simply this: Investing is hard; stocks go up AND down; if it were all that easy, everybody would be rich. There is an (easier said than done), relatively simple, 3-step solution to this: 1) Make a financial plan for your investments; 2) Ensure it matches your long-term needs and risk tolerances, and 3) Have the discipline to stick to that plan.

I am fond of saying that anyone can manage their own money if they have the time, patience, inclination, and emotional discipline to do so. The easy part is getting started, the difficult part is staying with it.

_________

1. There is some intriguing research in the earthquake insurance problem I am going to pull together and write up! It perfectly encapsulates the risk tolerance/timing issues.

click for audio