Today

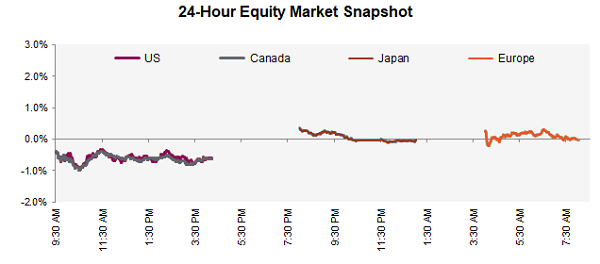

Stock futures are little changed this morning as investors braced for the latest commentary Jerome Powell today. Markets interpreted Powell’s comments last week as dovish, however, that may change after Friday’s blowout jobs report. In any case, Powell will get the opportunity to offer more clarity on where rates are heading, and clarify some comments made after last week’s 25 bps rate hike. Earnings reports and geopolitical concerns are also on the market’s radar this morning, as the U.S. attempts to recover remains of the Chinese balloon it shot down over the weekend.

It took a huge jobs report for the bond market to stop doubting the Fed. The peak level priced into the U.S. swaps curve for the Fed’s benchmark rate around midyear is now 5.12%, up from 4.91% as of Thursday’s close, matching the median view of Fed officials. Friday’s stronger-than-expected jobs numbers ignited the jump in front-end yields, while a slide in European bonds further fueled the rise yesterday. Before the release of the jobs report, investors were expecting a central bank pause, however now an increase in March, May, and June looks like a possibility. Still, the market is holding onto the belief that the central bank will begin cutting rates in the second half of the year, while the Fed is adamant that they will hold rates above 5% at least until next year.

The devastating earthquakes that shook parts of southern Turkey and Northern Syria has claimed the lives of over 5000 people, with thousands more injured or unaccounted for. In Syria, regional conflict may slow down rescue efforts as the country’s Northern region is already occupied by millions displaced by the country’s long waged civil war. In Turkey, a massive snowstorm and damage to infrastructure including airports and roads, has hampered rescue efforts. According to Turkey President Erdogan, assistance from 45 countries, the EU, and NATO (of which Turkey is a member) have offered aid or assistance. Just this morning Erdogan declared a three-month state of emergency for the southern parts of his country.

Flows into sustainable funds fell last year as political blowbacks and the general market decline shifted investor sentiment towards ESG funds. Despite the market rallying in January, ESG funds have continued to see outflows. In January, ESG ETFs in the U.S. saw net outflows of $772 million, a drastic drop when compared with the $953 million of inflows for the first month in 2022. Many ESG funds underperformed the market last year due to their high allocations to technology and growth stocks and limited exposure to the energy sector (the best-performing sector in the S&P 500 index in 2022). In total, sustainable mutual funds and ETFs took in a net $3 billion compared with $70 billion in 2021 and with investors remaining cautious considering recent economic data, these outflows may continue.

Joe Biden will speak at the State of the Union address to Congress today. It is widely expected that Biden will announce a bid for re-election next year, and today’s speech will provide a high-profile platform for him to make his case. If his recent speeches are any indication, he will likely celebrate his handling of the economy, citing low unemployment, slowing inflation rates, and robust GDP growth. Critics will be quick to point out that inflation remains high, and he will be under intense pressure to address the issue that has literally been hovering over the country since last week, the Chinese spy balloon and his handling of it.

Make some room ChatGPT, Bard is on the way. In a blog post published yesterday, Alphabet chief executive Sundar Pichai shared details of the company’s own conversational artificial-intelligence service called Bard, already launched to a select set of testers, with a broader public launch expected in the coming weeks. Google has faced criticisms due to its slow launch despite being a pioneer of some of the tools used to build ChatGPT which Microsoft-backed OpenAI launched late last year and quickly went viral. In response, Pichai noted that the company’s testing period is to ensure that Bard meets the “high bar for quality, safety and groundedness in real-world information.” Perhaps a slight dig at ChatGPT for some of its perceived less-than-high-quality responses. The technology aims to generate detailed answers when given simple prompts, such as what to make for lunch or how to plan a friend’s baby shower. We wonder if its first question to Bard was “how to beat ChatGPT?”

Diversion: Great teamwork.