Daily market commentary

The Launch Pad |

|

|

|

|

|  | |

|

Today

This morning, Bank of America reported a record quarter for its trading division, driven in part by heightened market volatility. It joins a growing list of U.S. banks, including Citigroup, Goldman Sachs, JPMorgan Chase, and Morgan Stanley, that saw a surge in trading revenue, boosting first-quarter profits. Elevated uncertainty has triggered sharp market swings, prompting some investors to actively reposition their portfolios, either dialing down risk or leaning into it. With these constant swings has come a rise in trading volumes. This uptick in activity has fueled trading desk revenues across the major banks, as reflected in their latest earnings reports. Speaking of trading, equity futures are lower this morning, following yesterday’s gains. In Europe, luxury stocks were down as bellwether LVMH reported a drop in sales (more details in company news below) as it deals with trade tensions and a decline in demand from China.

Inflation in Canada eased more than expected in March, with headline CPI rising 2.3% year-over-year, down from 2.6% in February, driven by lower gasoline and travel-related costs. Core inflation figures also came in below forecasts. This cooling inflation, combined with weak economic growth, job losses, and sluggish consumer spending, has fueled speculation that the central bank may continue its rate-cutting cycle despite earlier expectations of a hold. This comes as tariff-related uncertainty, especially from U.S. trade policies, continues to weigh on economic sentiment and inflation dynamics.

Canadian investors are feeling a little more patriotic. Investors poured $2.5 billion into Canadian equity ETFs last week, the biggest weekly inflow since 2021. The “Buy Canada” trade, comes as Canadian investors moved away from U.S. stocks amid rising trade tensions and market uncertainty. Analysts cite opportunistic dip-buying, stronger 2025 earnings prospects for some Canadian firms, more attractive valuations, and lower interest rates compared to the U.S. The ETF boom also highlights a broader "Buy Canada" trend as investors look to reduce U.S. exposure and find value closer to home.

Despite short-term risks, some strategists are noting that dips in European assets may present long-term buying opportunities, as recent market behaviour signals a potential rotation out of U.S. assets and into European ones. In a break from the norm during global growth scares, U.S. safe havens like the dollar and Treasuries failed to rally, with Treasuries falling and the dollar weakening. Meanwhile, European bonds attracted demand, seen by narrowing bund spreads and rising euro strength. Notably, the euro's correlation with the S&P 500 has turned negative, suggesting it could serve as both a safe haven during U.S. uncertainty and a beneficiary of global growth.

We have seen large intraday swings in the stock market since “Liberation Day”, with some of those big moves intensified by the rising popularity of zero-day-to-expiration (0DTE) options. These options are contracts that expire the same day they're traded, with trading in 0DTE options tied to the S&P 500 hitting 8.5 million in April, making up about 7% of total U.S. option volume. These instruments are used by institutional and retail investors for quick profits or to hedge against sudden market moves, but their high volume can amplify price swings as dealers rapidly adjust positions. The recent market chaos has led to extreme volatility, with the S&P 500’s intraday swings nearing levels not seen since the 2008 financial crisis. Analysts argue 0DTE options are a key factor behind the heightened intraday volatility, even if it doesn’t always show in daily closing prices.

Investment bankers are urging companies to delay U.S. IPO plans amid heightened market volatility caused by Trump's new tariffs and escalating trade tensions with China. Although expectations were high to start the year with Q1 poised for a busy quarter, the IPO calendar has been disrupted, with firms like StubHub, Klarna, and eToro putting their launches on hold. Bankers now expect a slowdown in IPO activity, possibly pushing new deals to the second half of the year. Market instability, scheduling around key events like the Fed meeting, and investors' growing risk aversion, reflected in falling indexes and a persistently high VIX, have created an uncertain environment.

We’ve heard stories of how AI will take jobs away from real people, but what about real people taking jobs away from AI? Albert Saniger, founder of the AI-based shopping app nate, has been charged with securities and wire fraud for allegedly deceiving investors by claiming the app used proprietary AI to automate online checkouts, when in fact the process was carried out manually by a team of workers in the Philippines. Despite raising tens of millions in funding (including a $38 million Series A round in 2021), nate never achieved true automation, with the Department of Justice stating its actual automation rate was effectively zero. Saniger is accused of concealing this fact from both investors and employees, ultimately leading to the company's collapse.

Diversion: Fumble |

|

|

(% equity weight) Our tactical fund is designed to complement your existing holdings to minimize portfolio volatility. To learn more, please click here.

|

|

| |  | |

|

|

Company news

Bank of America beat expectations for earnings and revenue on stronger-than-expected net interest income and trading revenue. Bank of America said that its NII benefited from lower deposit costs and higher-yielding investments compared with the year-earlier period. The bank’s sales and trading unit delivered its 12th consecutive quarter of year-over-year revenue growth. Bank of America said that net interest income, a key source of revenue for the company, rose 2.9% to $14.4 billion, compared to the estimate of a 2.3% increase for NII, the revenue collected from loan payments minus what depositors are paid.

Citigroup Inc. beat consensus earnings expectations and inched closer to a key profitability target in the first quarter as the firm’s traders surpassed expectations and the bank drew a record haul from its wealth and retail businesses. The trading division rode a wave of volatility in global markets to notch $6 billion in revenue for the period, helped by an 8% jump in fixed income and a 23% gain in equities trading. The bank’s wealth business, a key area of focus under CEO Jane Fraser, saw revenue jump 24% to a record $2.1 billion. The largest gain came from the bank’s Wealth at Work division, which provides tailored advice to lawyers and professional-services firms. Debt and equity underwriting revenue fell during the quarter as uncertainty surrounding Trump’s trade policies chilled some deal activity.

Johnson & Johnson raised its full-year outlook as it logged better-than-expected profit and revenue in the first quarter. J&J said its forecast includes tariff costs, dilution from its acquisition of Intra-Cellular and updated foreign exchange rates. It is holding its earnings outlook steady despite President Trump moving decisively toward imposing tariffs on the pharmaceutical industry. The administration’s investigation into drug imports announced Monday, widely seen as a first step toward imposing levies on the industry, could actually be beneficial, J&J CFO Joe Wolk said in an interview. He added that the investigation is likely to show most medicines shipped to the US are cheap generics, not the innovative therapies sold by J&J.

LVMH reported a worse-than-expected sales decline in Q1 2025, driven by weak demand in China and the U.S., as well as growing trade tensions. Its key fashion and leather goods division fell 5% organically, far exceeding analysts’ expectations of a 0.55% drop. Sales in the U.S. slipped 3%, while China saw an 11% decline, with only Europe showing growth. The company cited new U.S. tariffs on European goods and ongoing Chinese duties as major headwinds. LVMH is considering price increases and marketing cost adjustments but has no plans for major shifts in U.S. production. The results underscore broader concerns about a recovery in global luxury demand and the sector’s vulnerability to geopolitical risks.

|

|

|

|

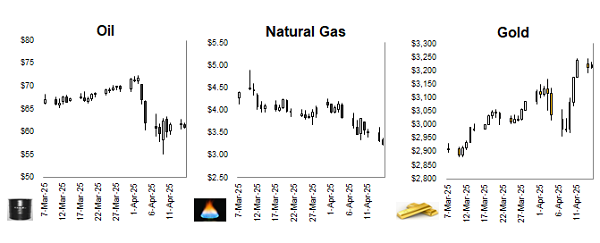

Commodities

Oil prices are lower as energy markets monitor the latest moves in the tariff war and fresh warnings from the International Energy Agency (IEA) over a persistent surplus. The IEA slashed its forecasts for demand this year by almost a third and predicted the oversupply will run into 2026. The monthly report showed projections for 2025 demand growth cut by a hefty 300,000 bpd , or almost a third, to 730,000 bpd, with half of the reduction concentrated in the U.S. and China. Also, consumption growth will be even slower in 2026, at 690,000 bpd, due to “a fragile macroeconomic environment” and the rising popularity of EVs. Concerns around the growth outlook have led agencies to cut demand views and analysts to slash price forecasts, with the possibility of a glut amplified by OPEC+’s surprise decision to bring back output more quickly than expected. Wheat inched higher as traders paused profit-taking to consider the impact on global stockpiles of poor weather in key exporters like the U.S. and Russia. Futures in Chicago rose slightly as less than half of the U.S. winter-wheat crop was reported to be in good to excellent condition, lower than the same period in 2024 and the week prior, according to the Department of Agriculture. Russia is also expecting to produce a below-average crop amid an ongoing drought. Limited rain this week will cause a decline in moisture for Black Sea crops. Last week, futures rose for five straight sessions, reaching the highest price in almost a month and prompting some to cash in.

|

|

|

|

|

Fixed income and economics

Markets got some relief from the deep selloffs and unusually sharp volatility yesterday and this was very evident in the U.S. Treasuries market. U.S. government bonds rebounded from a five-day selloff that last week sent 10-year yields surging by the most in over two decades and fanned fears that an accelerating selling of the securities would push the financial system toward a crisis. The bond market’s recovery pulled down the benchmark 10-year Treasury rate by about 12 basis points on Monday as bonds advanced across the curve. The move extended on Tuesday in Asia, with the 10-year yield falling three basis points to 4.35%, while yields on Australia and New Zealand sovereign notes also dropped. The rebound in bonds eased concerns that built last week, when a steady rise in yields threatened to deal the U.S. economy another hit by pushing up the cost of all kinds of loans. Treasury Secretary Scott Bessent moved to simmer down concerns about the market stating that he has tools to steady it, such as buybacks. He also dismissed and said there’s no evidence that overseas governments are selling their stockpiles of Treasuries.

|

|

|

|

Quote of the day  | What is right to be done cannot be done too soon

Jane Austen |  |

|

|

Contributors: A. Innis, A. Nguyen, P. Kwon

|

|

|

Charts are sourced to Bloomberg unless otherwise noted.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

|

|

| Address: 100 Queens Quay East, Suite 2500 Toronto ON M5E 1Y3 Canada

|

|

|

|

|