Today

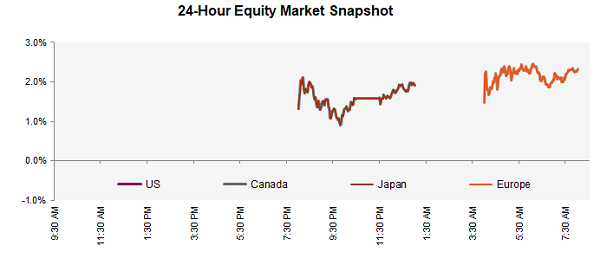

Tech equity futures are leading the way higher before the open as a tariff rollback brought some relief to the industry, even if temporary. The latest reprieve (revealed last Friday) has buoyed names such as Apple, and chip stocks like Micron and Nvidia. However by Sunday, Commerce Secretary Lutnick continued to zigzag and warned that despite the pause on reciprocal tariffs, many tech products will still face the semiconductor tariffs “in probably a month or two,” while President Trump posted on social media that “NOBODY is getting off the hook,” seeming to suggest that he had not in fact caved in to anyone’s demands. Tech gains also helped push overseas markets higher with Japan and South Korean indexes positive.

Are they in or out? Trump announced that while a temporary exemption has been granted on tariffs for phones, computers, and other electronics, these products will soon face sector-specific levies as part of a broader strategy to reshape the U.S. electronics and semiconductor supply chain. The exemption, covering over $390 billion in imports, is described as a procedural move to shift these goods into a different tariff category focused on reshoring key industries. Though this delay offers a brief window for lobbying and adjustments, Trump emphasized that no products are being let off the hook, signaling an aggressive push to reduce reliance on China and bolster domestic manufacturing.

Wild swings in global markets have kept investors on edge, with tariff concerns sparking volatility across equities, bonds, and currencies. While the S&P 500 rebounded after Trump softened some of his harshest levies (coincidentally just after he said “This is a great time to buy”), it remains significantly below its February peak. While tariff concerns will remain front of mind, investors will also be paying close attention to earnings season and upcoming U.S. retail sales data. Closer to home, investors in Canada await inflation data, set to be released on Wednesday and the BoC’s rate decision on Thursday.

A flurry of central bank activity this week. Global central banks are navigating economic uncertainty sparked by renewed U.S. trade tensions and tariff hikes, and this week we will get a glimpse of where their heads are at. While the European Central Bank is expected to cut rates, the Bank of Canada may hold steady amid inflation risks tied to U.S. tariffs. In the U.S., Fed officials will offer commentary ahead of their May meeting, with key data on retail sales, industrial production, and housing starts in focus. China’s GDP and inflation data may confirm a slowdown, while other major economies like the UK, Japan, and India will release inflation reports.

The sharp sell-off across U.S. financial markets since “Liberation Day”, with the S&P 500 down -5.4%, Treasury yields up, and the U.S. dollar hitting a three-year low, reflects growing investor concern over the long-term impact of Trump’s aggressive and unpredictable trade policies. The simultaneous decline in traditionally safe-haven assets like the dollar and Treasurys suggests a broader loss of confidence in the U.S. as a financial anchor, with fears of de-dollarization and reduced foreign appetite for U.S. debt. Rising yields threaten to worsen the federal deficit, while looming tariff-driven inflation could limit the Fed’s ability to cut rates, compounding economic uncertainty and undermining America’s global economic standing. Quite a conundrum.

The recent spike in market volatility, with the VIX reaching 60, was not driven by derivatives trading, unlike past episodes. Instead, the VIX's movement tracked closely with the S&P 500 and its futures, showing stable beta and suggesting a more natural response to macro uncertainty rather than technical dislocations. Investors, anticipating tariff-driven shocks, appeared to monetize existing hedges rather than panic-buy protection, helping limit volatility's rise. The VIX remains over 20 points above its one-year average, signaling market expectations of a more serious and prolonged volatility phase.

China has launched a global diplomatic campaign to rally opposition against U.S. trade measures. While Beijing had initially sought dialogue and a cooperative “win-win” outcome, the breakdown in communication channels and lack of high-level U.S. engagement pushed China to escalate its response. Chinese diplomats are engaging countries also affected by Trump’s tariffs, looking to build a united front against Trump. At home, experts have noted that the communist government is using propaganda to emphasize resilience, and the government is shifting focus toward boosting domestic consumption to reduce reliance on exports. This pivot comes amid concerns over inflation, stalled negotiations, and China’s efforts to reshape the global narrative in its favour.

Poppy’s putt may have been foreshadowing. Rory McIlroy’s pursuit of a Grand Slam and a bid to end an 11-year major championship drought came to a dramatic, unforgettable conclusion. Anyone who watched over the weekend, and especially during yesterday’s sudden death playoff, felt the agonizing tension that comes with trying to will a player to victory through the TV screen. We saw Rory confront not just Augusta’s punishing greens, but perhaps more poignantly, his own inner demons. The intensity, the misses (double-bogey to open!), the weight of expectation, all came to a head. In front of a roaring crowd, Rory triumphed and finally put on the green jacket that had eluded him for so long. How he completed the Grand Slam feels perfectly aligned with the rollercoaster journey he's had. As Rory put it himself, it was "a battle with myself," and in conquering that battle, he claimed his place in golf history. The win marks his fifth major title and makes him the sixth golfer ever to win all four majors, and the first European to do so. For those who didn’t have time to watch the entire Masters play out, here in 16 short minutes is Rory’s final round.

Diversion: Next Level Marketing