Daily market commentary

The Launch Pad |

|

|

|

|

|  |

|

|

Today

Stocks rose this morning as companies continue to report better-than-expected earnings. The moves come after the S&P 500 yesterday climbed out of correction territory and posted its best day since late August. Still, major indices remain on pace to end the month in the red, with the Dow and the S&P 500 at -1.7% and -2.8% in October, while the TSX is -3.5%. The Nasdaq has declined more than 3% month to date, which means that all North American indexes are looking to see their third consecutive negative month.

Now that’s scary. Preliminary data from Stats Canada indicates that the Canadian economy is on track to enter a technical recession, with an estimated minor contraction in the third quarter. The data reveals that GDP remained unchanged for the third consecutive month in September. The three months of flat output, following a 0.2% decline from April to June, suggest a 0.1% annualized decrease in the third quarter. This pace is significantly slower than the 0.8% growth projected by the Bank of Canada. The report supports the central bank's view that past interest rate increases are slowing demand and allowing supply to catch up. Consequently, price pressures are expected to gradually moderate, allowing policymakers to remain on the sidelines.

Much to the ECB’s delight, Eurozone inflation has fallen to its lowest level in over two years. In October, consumer prices increased by 2.9%, a decrease from the previous month's 4.3% and slightly below the 3.1% estimate in a survey of economists. That wasn’t the only thing that fell unfortunately, with the eurozone's third-quarter GDP decreasing by 0.1%. These numbers show that while the ECB's rate hikes are having some success in bringing inflation closer to the 2% target, they are also placing pressure on households and businesses as borrowing costs surge. While the ECB aims for inflation control, it is keen to avoid further damage to the economy and remains cautious about discussing rate cuts. The ECB's President, Christine Lagarde, anticipates a weak economy for the rest of the year but expects a gradual recovery over the coming years as inflation subsides, and household incomes improve. Despite the bleak economic backdrop, markets anticipate the ECB's deposit rate to remain at 4% until at least April.

Flirting with correction. Despite rebounding yesterday, the S&P 500 officially entered correction territory on Friday, down 10% from its peak in July. The past three months of decline have pushed valuations lower, with various indicators signaling growing bearish sentiment. However, historically, late October often marks the end of seasonal weakness, giving rise to a holiday rally. And despite short-term headwinds, strategists believe that the S&P 500's fundamentals can provide positive surprises. Last year Santa’s rally arrived early, only to reverse course by December. Let’s see what’s in store for us this year.

Higher borrowing costs are putting pressure on emerging-market companies who need to refinance $400 billion worth of debt maturing in the new year, with another $300 billion of corporate bonds coming due in 2025. Analysts are noting that high-quality companies might experience an interest rate spike, while lower-rated firms may encounter failed refinancing deals, potentially leading to defaults or bankruptcies, particularly for companies from China, Argentina, Brazil, and Ukraine. While it's expected that high-quality companies may weather the storm, a vulnerable section of the market may remain at risk. High-yield companies are particularly susceptible to default risks, and investors are becoming more selective, which could lead to reduced allocation to lower-rated and frontier markets.

Consumer discretionary stocks have stood out in a strong quarter for earnings, with companies like McDonald's, Chipotle Mexican Grill, Amazon, Hilton, and Royal Caribbean surpassing expectations. So far, 78% of the S&P 500 companies that have reported results so far have exceeded earnings estimates, with consumer discretionary companies leading the way by exceeding estimates by an average of 19%. The consumer-facing companies have maintained higher selling prices and benefited from a drop in raw material costs, boosting profit margins. The performance of these stocks reflects consumer resilience in the face of expectations of a U.S. economic slowdown, with a 4.9% rise in U.S. GDP in the third quarter highlighting consumer health.

Young Canadians are reportedly more anxious about personal debt and more likely to have missed a bill payment compared to other age groups, according to Equifax Canada. Perhaps a move back home to shore up savings may help ease the angst. The survey, conducted in September, revealed that 52% of respondents between 18 and 34 are concerned about their personal debt, compared to 39% overall. Additionally, 36% of younger adults said they had missed a bill payment this year, compared to 23% overall. Equifax also noted that credit card debt in Canada reached an all-time high in Q2, particularly affecting lower-income households. Housing is a top concern, with 30% seeking extra income to cover mortgage or rent payments, and nearly 20% saying they may need to move due to affordability issues.

The yen saw a sharp rally yesterday on reports that the Bank of Japan is considering raising the cap on government bond yields during its policy meeting. The reports suggest that Japanese policymakers are exploring the possibility of allowing the yield on 10-year government bonds to surpass 1%. That didn’t last long though, with the yen seeing its sharpest decline in two months this morning following the BoJ’s limited policy adjustments, disappointing some market participants. The yen's retreat brought it below the 150 per dollar mark after the central bank reaffirmed its commitment to yield curve control, with 1% as a reference point. The Bank of Japan's shift in policy direction is closely observed due to its tight control of the bond market since the introduction of yield-curve control in 2016, which has now become more flexible regarding 10-year government debt yields. The prospect of a weaker yen and negative interest rates could lead to further gains for Japanese equities, with the Nikkei 225 already showing an 18% year-to-date rally.

More tricks than treats. A recent poll found that Canadians are split on whether to hand out Halloween candy tonight, with 48% of respondents planning to give out candy, 46% choosing not to (this number was surprising), and 6% undecided. For households with children, 63% intend to distribute candy. Additionally, 71% of Canadians expect to spend a similar amount on Halloween this year compared to last year, while 15% are reducing their spending and 11% are increasing it. On average, Canadians who spend on Halloween allocate $64.20 for costumes, candy, decorations, and related expenses, while parents spend an average of $115.80. Which side of the Halloween aisle are you on, trick or treat?

Diversion: What are you going as? |

|

|

(% equity weight)

Our tactical fund is designed to complement your existing holdings to minimize portfolio volatility. To learn more, please click here.

|

|

| |  |

|

|

Company news

General Motors Co. has reached a tentative contract agreement with the United Auto Workers union, and has hopefully ended a six-week-old strike that had upended US automobile production and cost the industry billions of dollars. The terms of the pact are broadly similar to the deals signed earlier by Ford Motor Co. and Stellantis NV, including a 25% hourly pay raise plus cost-of-living allowances over the more-than-four-year contract, however, it wasn’t immediately clear if there were differences in terms including in retiree benefits, which has been a sticking point. GM’s 46,000 union members still must approve the deal.

Canadian grocers have presented plans to the federal government aimed at stabilizing food prices. Senior cabinet ministers summoned the leaders of the top five grocery chains to Ottawa and ordered them to come up with a plan, and while the plans have not been made public, the government has stated that they will include aggressive discounts on staples, price freezes, and price-matching campaigns. One of the biggest offenders (according to the public), Loblaws, said its plans include larger discounts on staple products, expanded price-match programs, and “members’ only” discounts. Walmart and other grocery chains are also taking steps to fight inflation and offer affordable pricing on staple products.

Canadian Solar Inc. is set to construct an $800 million solar panel factory in southeastern Indiana, with production expected to begin by the end of 2025. The facility will generate around 1,200 jobs once it reaches full production, producing approximately 20,000 high-power solar panels each day. The finished solar cells will be shipped to Canadian Solar's module assembly facility in Mesquite, Texas. The Indiana Economic Development Corporation will provide Canadian Solar with up to $9.7 million in tax credits and up to $400,000 in conditional training grants to support the project.

BlackBerry's CEO, John Chen, has reportedly resigned, and his departure is expected to occur on Friday. The reason for his resignation has not been disclosed. Chen had been leading BlackBerry's transformation from a consumer hardware company to one focused on enterprise software, cybersecurity, in-car software, and Internet of Things(IoT) applications. The company recently announced plans to separate its IoT and cybersecurity units and pursue a subsidiary IPO for the IoT business in the next fiscal year. Last year, BlackBerry discontinued its smartphones business and aimed to sell its legacy mobile device-related patents.

First Quantum Minerals Ltd. saw its largest intraday drop in 26 years as Panama's government announced a referendum on the Canadian mining company's flagship copper mine. The referendum aims to resolve mass civil unrest resulting from a new contract that granted First Quantum a 20-year extension on its mining license for the Cobre Panama mine. Demonstrations broke out across Panama, prompting President Laurentino Cortizo to set a vote for December 17 to determine whether the license should be revoked. The mine is essential to Panama's economy, accounting for approximately 4% of its GDP.

|

|

|

|

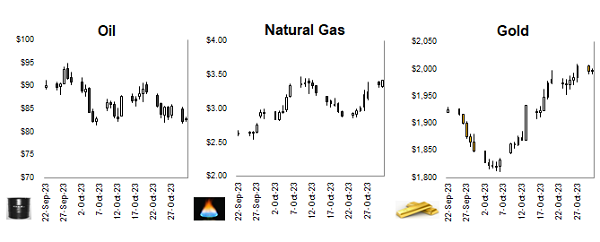

Commodities

Oil prices are higher rebounding from a steep drop yesterday on signs that the Israel-Hamas war will remain contained while demand may be softening. Crude benchmarks are wrapping up a turbulent month, with prices swayed by the war and mixed indicators on demand. Both WTI and Brent are on course to cap declines in October as the risk premium triggered by the conflict fades, with concerns of a global slowdown returning to focus. Data from Asia highlighted the risks as manufacturing in China fell back into contraction. Wheat prices are at the lowest in more than two weeks in Chicago as improving conditions in some key growers bolstered the outlook for crops. In its initial estimate of the season for winter wheat, the US Department of Agriculture said 47% of the crop was rated good or excellent. That matched analyst expectations and marked the best conditions for this time of year since 2019.  |

|

|

|

Fixed income and economics

The market is setting its attention towards the Fed’s policy statement and the U.S. Treasury Department's quarterly refunding announcement this week. The U.S. Department of the Treasury has announced that the government's borrowing needs will decline slightly in the final three months of 2023 compared to the prior quarter. The Treasury intends to borrow $776 billion during this period, down from the $1.01 trillion borrowed in the July-September quarter, the highest ever for that particular period. This lower borrowing level was somewhat below Wall Street expectations, and it comes as the government has been under pressure to address rising yields and their impact on financial markets. On the policy decision side, the Fed is expected to make no changes in interest rates, making the Treasury's refunding announcement the main point of interest this week.

Yesterday several U.S. blue-chip companies joined a wave of bond sales in anticipation of a week packed with bond auctions, central bank meetings, and economic data releases. Issuers sought to get ahead of significant events, including Fed meetings, a Bank of Japan policy meeting, U.S. government debt announcements, and the release of U.S. payroll data. This move comes as stocks rebound, high-grade risk premiums tighten, and credit default swap spreads show reduced market risk perception. Overall, these factors create a favourable backdrop for bond sales, and market participants anticipate a busy few weeks for issuers in the corporate bond market.

|

|

|

|

Quote of the day

| Out of difficulties grow miracles.

Jean de la Bruyere |  |

|

|

Contributors: A. Innis, A. Nguyen, P. Kwon

|

|

|

Charts are sourced to Bloomberg unless otherwise noted.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

|

|

| Address: 100 Queens Quay East, Suite 2500 Toronto ON M5E 1Y3 Canada

|

|

|

|

|